Oh, and by the way, always giving glory to our Lord, Jesus Christ! He comes first. Always.

Any thoughts on the Vanguard Target funds? Target funds are the set it and forget it option to retirement with automatic changes to your portfolio allocations of stocks and bonds over time.

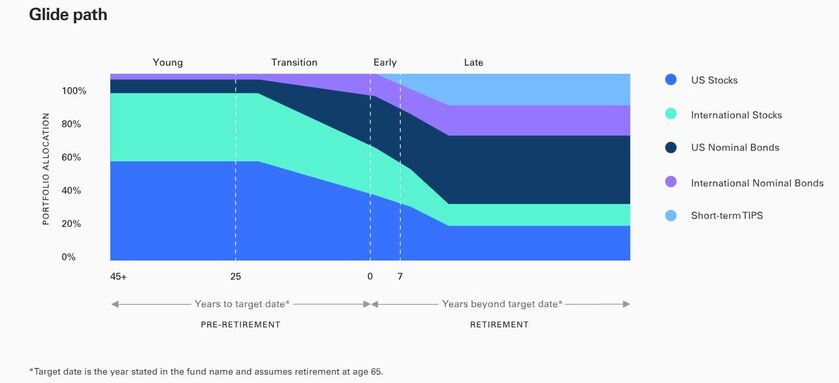

I found the glide path graphic below from the Vanguard website at <https://advisors.vanguard.com/investments/products/vtinx/vanguard-target-retirement-income-fund#overview> interesting.

I'm not a big fan of foreign stocks and bonds due to their low historic returns, but the eggheads at Vanguard are probably right in that they provide diversification against US market losses.

At <https://corporate.vanguard.com/content/corporatesite/us/en/corp/vemo/vemo-return-forecasts.html> Vanguard is predicting foreign stocks will outperform domestic ones over the next 10 years. I wonder how accurate Vanguard's market forecasts have been in the past.

I find it interesting that the final portfolio allocation of their Retirement Income fund doesn't kick in until ~10 years into retirement and the chart assumes the retirement age of 65.

Ed McQuarrie talks the REAL History of Stocks and Bond performance.

Worried About a Stock Market Crash? Here’s What You Should Be Worried About Instead. - Barron's https://share.google/zxmc1t7eE4TLrdHPh

Read this article from Barron's