Josh Scandlen

Destroying the doom and gloom when it comes to retirement planning and lots of other stuff too.

Oh, and by the way, always giving glory to our Lord, Jesus Christ! He comes first. Always.

Oh, and by the way, always giving glory to our Lord, Jesus Christ! He comes first. Always.

Interested? Want to learn more about the community?

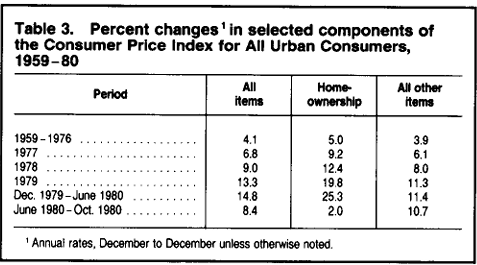

CPI simply does not measure what people think it does when it comes to inflation. Did costs for homeowners actually increase 19% in 1979? After a 12.4% increase in 1978?

Of course not. Yet this was part of the CPI numbers. It's even worse now with Owners Equivalent Rent (OER) too.

Sadly, there is no right answer when it comes to measuring inflation. "Just measure a basket of goods, Josh! That's all you need to do!"

Ugh, if Ribeye goes up say 50% and chicken remains the same, what will I consume more of? Chicken, indeed. So, how does inflation account for the change in consumption? See how dicey this is? It's not an easily solvable problem.

Interested? Want to learn more about the community?

What else you may like…

Videos

Posts

Stocks For the Long Run? Maybe...Maybe Not

Ed McQuarrie talks the REAL History of Stocks and Bond performance.

01:08:52

00:00:50