Josh Scandlen

Destroying the doom and gloom when it comes to retirement planning and lots of other stuff too.

Oh, and by the way, always giving glory to our Lord, Jesus Christ! He comes first. Always.

Oh, and by the way, always giving glory to our Lord, Jesus Christ! He comes first. Always.

Interested? Want to learn more about the community?

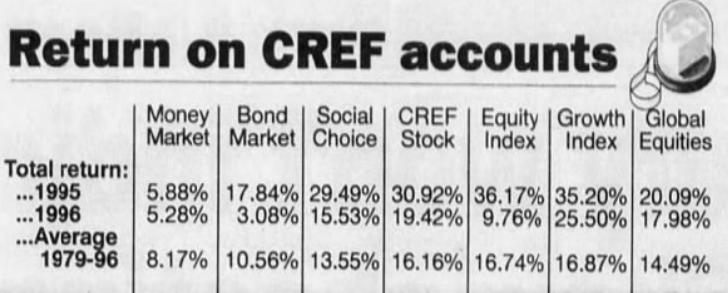

Returns Like This Will Never Happen Again

Folks, do you see these returns? That was from 1979 to 1996, 17 years. And the good times went on another 3 years too.

These returns are part of the history of total returns in the markets. Yet, you're never going to see this again. Nearly 17% annually for stocks and almost 11% for bonds.

Nope. Those days are gone.

Interested? Want to learn more about the community?

What else you may like…

Videos

Posts

Stocks For the Long Run? Maybe...Maybe Not

Ed McQuarrie talks the REAL History of Stocks and Bond performance.

01:08:52

00:00:50