Oh, and by the way, always giving glory to our Lord, Jesus Christ! He comes first. Always.

So, let's see. We use the solar farms in Nevada, California and Arizona to generate electricity and then we transmit it all over the country to distribute it to your neighborhood. Yes, that will be significantly cheaper than LOCAL power generation via fossil fuels!

Good luck with your solar farms in Maine and other less-sunny states.

(My friends, we are not dealing with the brightest bulbs here.)

"Electricity prices vary by type of customer

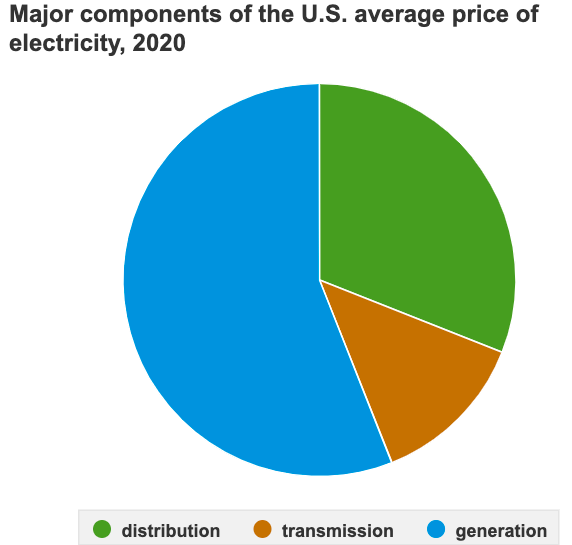

Electricity prices are usually highest for residential and commercial consumers because it costs more to distribute electricity to them. Industrial consumers use more electricity and can receive it at higher voltages, so supplying electricity to these customers is more efficient and less expensive. The price of electricity to industrial customers is generally close to the wholesale price of electricity.

In 2020, the U.S. annual average retail price of electricity was about 10.66¢ per kilowatthour (kWh).1"

Ed McQuarrie talks the REAL History of Stocks and Bond performance.